What is Ethereum Staking?

Table of Contents

Introduction to Ethereum Staking

Ethereum staking is a process that allows ETH holders to actively participate in securing the Ethereum network while earning rewards. Since Ethereum's transition to Proof of Stake in September 2022 (an event known as "The Merge"), staking has become the fundamental mechanism that secures the blockchain, validates transactions, and creates new blocks.

At its core, staking involves depositing ETH to activate validator software, which processes transactions, stores data, and adds new blocks to the blockchain. This replaces the energy-intensive mining process that Ethereum previously used, resulting in a more sustainable and accessible system.

Network Security

Validators secure the blockchain

Earn Rewards

~3-5% annual yield

Multiple Options

Various ways to participate

In this comprehensive guide, we'll explore the fundamentals of Ethereum staking, how it works, the rewards you can earn, different ways to participate, and important considerations for anyone interested in staking their ETH.

The Fundamentals of Proof of Stake

Proof of Work vs. Proof of Stake

To understand Ethereum staking, it's important to grasp the basics of the Proof of Stake consensus mechanism that underlies it. Unlike the previous Proof of Work system, where miners competed through computational work, Proof of Stake selects validators based on the amount of ETH they have staked.

This fundamental shift has transformed how Ethereum achieves consensus, processes transactions, and maintains security, while dramatically reducing its environmental impact.

Key Elements of Proof of Stake

Validators Instead of Miners

In Proof of Stake, validators replace miners as the participants who maintain the network. While miners competed through computational work, validators are selected based on the amount of ETH they have staked and other factors.

Economic Security

The security of the network comes from validators having an economic stake in its proper operation. Validators must deposit 32 ETH as collateral, which can be reduced (slashed) if they act maliciously or fail to perform their duties properly.

Energy Efficiency

Unlike Proof of Work, which requires enormous amounts of energy for computational puzzles, Proof of Stake requires minimal computational resources. This has reduced Ethereum's energy consumption by approximately 99.95%.

Did You Know?

Ethereum's transition to Proof of Stake reduced its energy consumption by approximately 99.95%, making it one of the most environmentally friendly blockchain networks. A single Ethereum transaction now uses about the same amount of electricity as a few minutes of watching YouTube.

How Ethereum Staking Works

The staking process involves several key components and activities that work together to secure the Ethereum network while rewarding participants:

How Ethereum Staking Works

The Validator Lifecycle

- 1Deposit and activation: A validator begins by depositing 32 ETH to the Ethereum deposit contract. After the deposit is recognized, the validator enters an activation queue before becoming active.

- 2Active validation: Once activated, the validator participates in the consensus process by proposing and attesting to blocks.

- 3Rewards accumulation: For their service, validators earn rewards in ETH, which are distributed periodically.

- 4Exit (optional): Validators can choose to exit the validation process, after which they can withdraw their stake and accumulated rewards.

Validator Responsibilities

Validator Responsibilities

Attestation Duties

- • Verify the proposer's block is valid

- • Confirm the current state of the blockchain

- • Submit votes as part of a committee

Importance

- • Attestations secure the network through consensus

- • Majority of validator rewards come from attestations

- • Helps prevent chain forks and attacks

Frequency

The Beacon Chain

The Beacon Chain

The Beacon Chain is the coordination layer for Ethereum's Proof of Stake system. It serves as the backbone of the staking mechanism, managing validators and coordinating the consensus process.

- •Tracks validators and their stakes

- •Randomly assigns validators to block proposal and attestation duties

- •Implements the consensus rules and penalties

- •Distributes rewards to validators

Staking Rewards: How and Why They're Earned

Validators earn rewards for their participation in the network's consensus process. These rewards serve as an incentive for validators to act honestly and maintain the security of the network.

Base Rewards

For attestations and proposals

Priority Fees

From transaction fees

MEV

Maximal Extractable Value

Sources of Rewards

Base Rewards

These are the primary rewards issued by the protocol for successful attestations and block proposals. Base rewards are calculated based on the validator's effective balance and the total number of active validators in the network.

Priority Fees

Users can include priority fees (tips) with their transactions to incentivize validators to include them in blocks. When a validator proposes a block, they receive all the priority fees from the transactions included in that block.

MEV (Maximal Extractable Value)

MEV refers to the value that can be extracted by reordering, including, or excluding transactions within a block. Validators can capture MEV through various strategies or by using MEV-boost relays that connect them to block builders who optimize for MEV extraction.

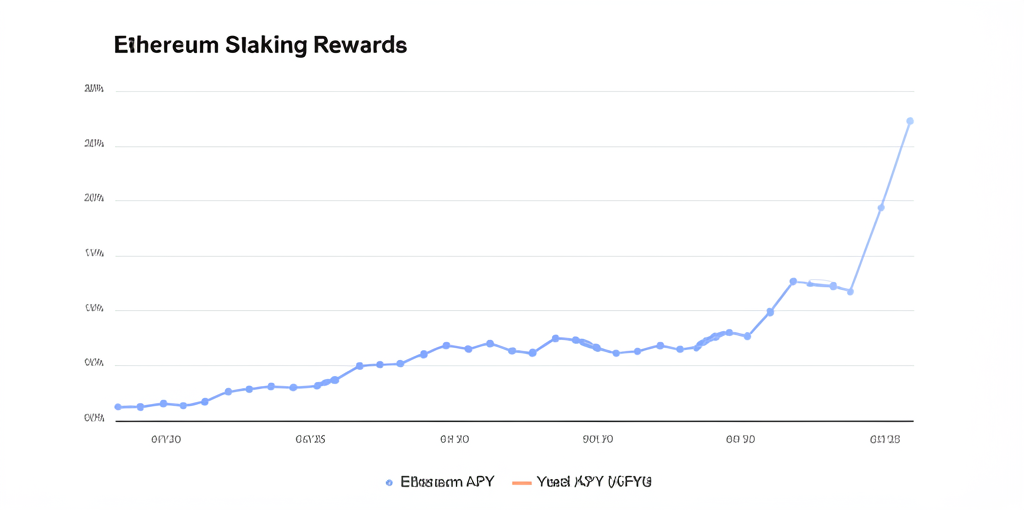

Reward Rates and Factors

The annual percentage rate (APR) for staking varies based on several factors:

- •Total ETH staked: As more ETH is staked, the reward rate decreases (to prevent over-issuance)

- •Validator performance: Validators that maintain high uptime and correctly perform their duties earn optimal rewards

- •Network activity: Higher transaction volumes generally lead to higher priority fees

Current staking APRs typically range from 3% to 5%, though this can vary based on the factors above.

Calculate Your Potential Rewards

Ethereum Staking Calculator

Estimated Returns

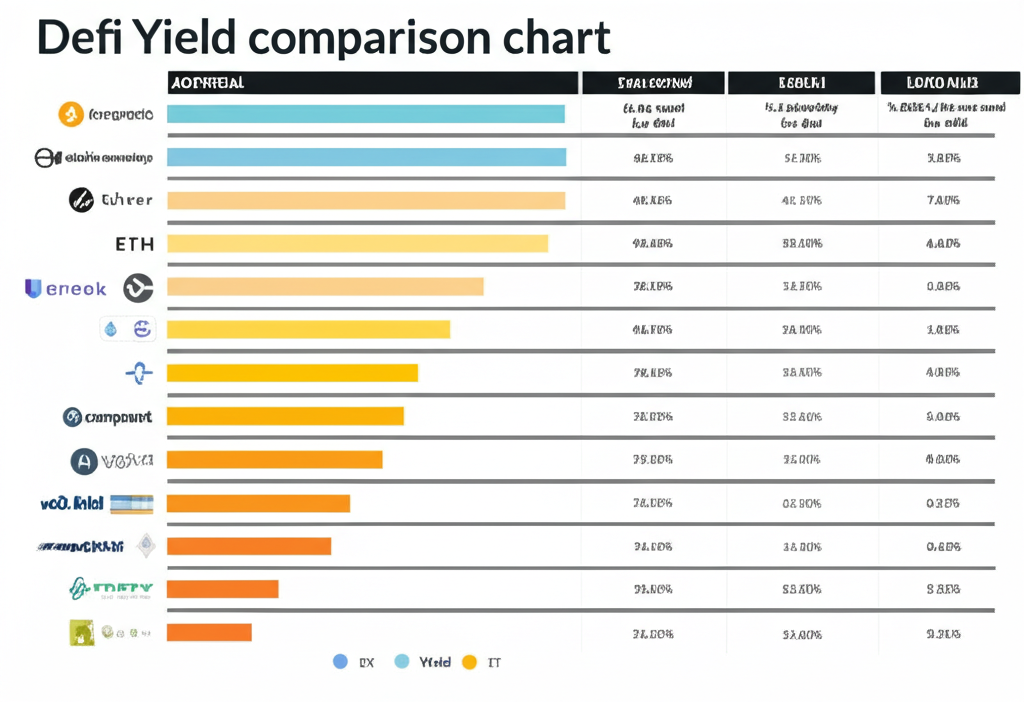

Different Ways to Participate in Ethereum Staking

There are several approaches to staking ETH, each with different requirements, risks, and rewards. The right option for you depends on your resources, technical expertise, and investment goals.

+ Hardware & Technical Skills

No Hardware Needed

No Minimum

Varies by Exchange

Solo Staking (32 ETH)

Running your own validator node with 32 ETH is the most direct form of participation in Ethereum staking. This option gives you complete control over your validator setup and operations, but also requires technical knowledge and dedicated hardware.

Requirements

- • 32 ETH

- • Dedicated computer

- • Stable internet connection

- • Technical knowledge

Benefits

- • Maximum rewards (no third-party fees)

- • Complete control over validator

- • Direct contribution to decentralization

- • Privacy and security

Solo staking is ideal for those who want to maximize their rewards and have the technical skills to set up and maintain a validator node. For a detailed guide on setting up your own validator, see our solo staking complete guide.

Staking as a Service (32 ETH)

This option allows you to delegate the technical operation of your validator while maintaining ownership of your 32 ETH. Staking-as-a-Service providers handle the setup, maintenance, and monitoring of validator nodes on your behalf.

Requirements

- • 32 ETH

- • No technical expertise needed

- • No hardware required

Considerations

- • Service fees (typically 5-15%)

- • Reliance on third-party infrastructure

- • You still own the validator keys

Staking as a Service is a good middle ground for those who have 32 ETH but lack the technical expertise or desire to run their own validator node. Popular providers include Kiln, Staked.us, and Allnodes.

Pooled Staking (Any Amount)

Pooled staking allows participation with less than 32 ETH by combining funds with other stakers. This approach makes staking accessible to a wider range of ETH holders and is ideal for those with smaller amounts of ETH.

Requirements

- • Any amount of ETH

- • No technical expertise needed

- • No hardware required

Popular Options

- • Rocket Pool (minimum 0.01 ETH)

- • Stakefish (minimum 0.1 ETH)

- • StakeWise (no minimum)

Pooled staking typically involves lower rewards due to pool fees, but offers greater accessibility and convenience. For more information on staking with smaller amounts, see our guide on staking with less than 32 ETH.

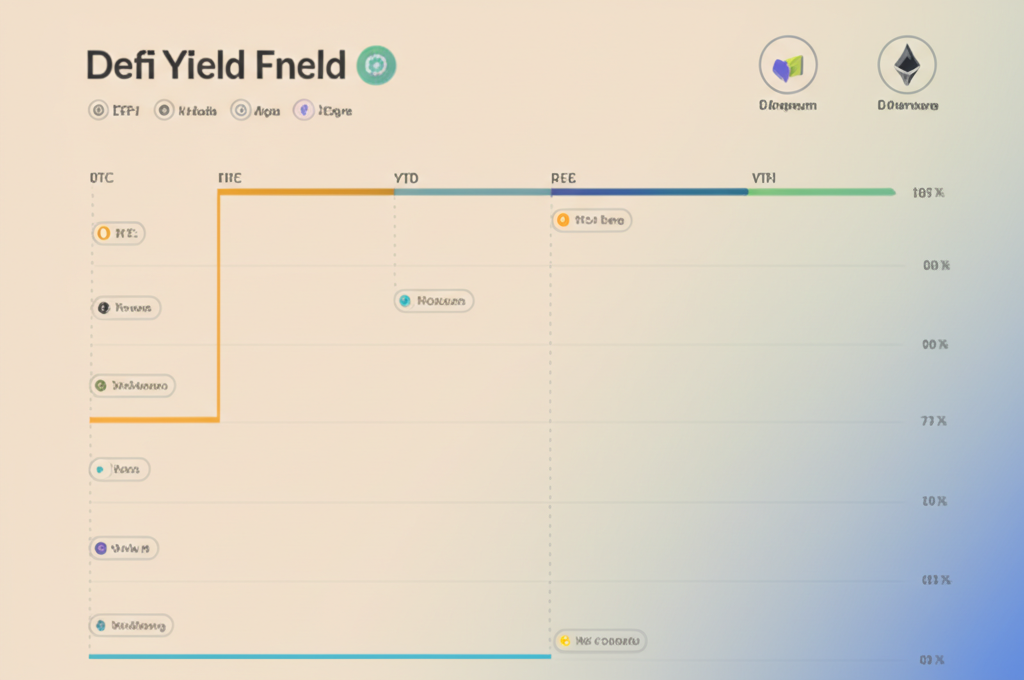

Liquid Staking (Any Amount)

Liquid staking protocols issue tokens representing staked ETH, allowing for liquidity while staking. This innovative approach enables users to stake their ETH while still maintaining the ability to use their assets in other DeFi applications.

How It Works

- • Deposit ETH to the protocol

- • Receive liquid staking tokens (e.g., stETH)

- • Use tokens in DeFi while earning staking rewards

Popular Protocols

- • Lido (stETH)

- • Rocket Pool (rETH)

- • Frax (frxETH)

- • Coinbase (cbETH)

Liquid staking has become one of the most popular ways to stake ETH due to its flexibility and capital efficiency. To learn more about liquid staking options, check out our article on liquid staking derivatives explained.

Exchange Staking (Any Amount)

Many cryptocurrency exchanges offer staking services, allowing users to stake their ETH directly through the exchange platform. This is often the simplest option for beginners or those who already keep their ETH on exchanges.

Advantages

- • Extremely simple user experience

- • No minimum in many cases

- • Integrated with existing exchange accounts

Considerations

- • Higher fees (often 25%+ of rewards)

- • Exchange maintains custody of your ETH

- • Centralization concerns

Exchange staking is ideal for those who prioritize simplicity and already use exchanges for their crypto holdings. Popular exchanges offering ETH staking include Coinbase, Binance, and Kraken.

Risks and Considerations in Ethereum Staking

While staking offers attractive rewards, it's important to understand the associated risks before committing your ETH. Different staking methods come with different risk profiles, and being aware of these risks can help you make informed decisions.

Validator Risks

- •Slashing: Validators can lose a portion of their stake for malicious behavior or serious technical failures

- •Penalties: Minor penalties for being offline or failing to attest properly

- •Technical failures: Hardware or software issues can impact validator performance

Market Risks

- •Price volatility: The value of ETH can fluctuate significantly

- •Opportunity cost: Staked ETH cannot be used for other purposes (unless using liquid staking)

- •Liquidity risk: There may be delays when withdrawing staked ETH

Protocol Risks

- •Smart contract vulnerabilities: Particularly relevant for pooled and liquid staking

- •Protocol changes: Future Ethereum upgrades could affect staking mechanics

- •Centralization risks: Concentration of stake in a few entities could affect network security

Risk Mitigation Strategies

- •Diversification: Consider spreading your ETH across different staking methods

- •Due diligence: Research providers thoroughly before committing your ETH

- •Start small: Begin with a smaller amount to gain experience before committing more

- •Stay informed: Keep up with Ethereum developments and protocol changes

For a more comprehensive analysis of these risks, see our article on understanding the risks of Ethereum staking.

The Technical Architecture of Ethereum Staking

For those interested in the technical aspects, Ethereum's staking system involves several components that work together to maintain the network's security and process transactions.

Client Software

Validators run two types of client software that work together to participate in the Ethereum network:

Execution Client

Handles transactions, smart contracts, and maintains the state of the blockchain.

Consensus Client

Implements the Proof of Stake protocol and coordinates with other validators.

The Validator Key Pair

Each validator uses two key pairs that serve different purposes in the staking process:

- •Signing key: Used for day-to-day validator operations like attesting and proposing blocks. This key needs to be available to the validator software.

- •Withdrawal key: Used to withdraw staked ETH and rewards. This key should be kept in cold storage for maximum security.

Proper key management is crucial for validator security. The signing key should be accessible but secured, while the withdrawal key should be stored with the highest security measures.

The Deposit Contract

The deposit contract is the bridge between Ethereum's execution layer and consensus layer:

- •It receives the 32 ETH deposits from prospective validators

- •It registers validator public keys and initial deposits

- •It serves as the canonical record of validator registrations

Client Diversity

Running diverse client implementations helps improve network security by preventing any single implementation from having too much influence over the network. If a bug affects one client, others can continue to function correctly.

For more information on the importance of client diversity, see our article on client diversity in Ethereum staking.

The Future of Ethereum Staking

Ethereum staking continues to evolve with several developments on the horizon that will shape its future. These upcoming changes aim to improve scalability, security, and user experience for stakers.

Ethereum Roadmap

The Merge (2022)

Transition to Proof of Stake

Shanghai (2023)

Enabled staking withdrawals

Sharding

Horizontal scaling solution

Single Slot Finality

Faster transaction finality

Proposer-Builder Separation

Improved MEV distribution

Protocol Upgrades

- •Sharding: Will distribute the network's data storage needs across multiple "shards," potentially increasing staking rewards for validators who secure these shards

- •Single Slot Finality: Aims to reduce the time needed for transaction finality, making the network more efficient

- •Proposer-Builder Separation: Will change how blocks are created and proposed, potentially affecting MEV distribution

Staking Innovations

Distributed Validator Technology (DVT)

DVT allows validators to operate across multiple machines for improved security and uptime. This technology distributes the validator's signing responsibilities across several nodes, reducing the risk of downtime and slashing.

Restaking

Protocols like EigenLayer allow staked ETH to secure multiple protocols simultaneously. This innovation enables validators to earn additional rewards by providing security to other networks without unstaking their ETH.

Advanced Liquid Staking Derivatives

More sophisticated financial products built on staked ETH are emerging, offering features like yield-bearing tokens, governance rights, and integration with DeFi protocols for enhanced capital efficiency.

Institutional Adoption

Institutional investors are increasingly entering the Ethereum staking space, bringing significant capital and professional infrastructure. This trend is expected to continue as regulatory clarity improves and institutional-grade staking services develop.

For more information on institutional staking, see our article on ETH staking for institutions.

Getting Started with Ethereum Staking

If you're interested in starting your staking journey, here are some steps to consider:

Step-by-Step Guide to Staking

Assess Your Resources and Goals

- •Amount of ETH: Determine how much ETH you're willing to stake

- •Technical comfort: Evaluate your technical skills and willingness to manage validator hardware

- •Time commitment: Consider how much time you can dedicate to monitoring and maintaining your stake

Choose Your Staking Method

Based on your assessment, select the staking approach that best fits your situation:

- •Solo staking for those with 32 ETH and technical skills

- •Staking as a service for those with 32 ETH but limited technical skills

- •Pooled or liquid staking for those with less than 32 ETH

- •Exchange staking for those prioritizing simplicity

Research Providers (If Not Solo Staking)

If using a staking service, pool, or liquid staking protocol:

- •Compare fees and historical performance

- •Assess security measures and track record

- •Consider the level of decentralization

Set Up and Monitor

- •Follow the specific setup instructions for your chosen staking method

- •Establish a monitoring system to track validator performance and rewards

- •Stay informed about Ethereum updates that might affect staking

For a more detailed beginner's guide, see our article on Ethereum staking for beginners.

Recommended Resources

Official Resources

Community Resources

Conclusion: The Value Proposition of Ethereum Staking

Ethereum staking represents a significant evolution in how blockchain networks achieve consensus and distribute rewards. By allowing ETH holders to actively participate in securing the network, staking creates a more sustainable, accessible, and potentially more secure system than previous approaches.

Whether you're interested in the technical aspects of running a validator, seeking passive income from your ETH holdings, or simply want to support the Ethereum network, staking offers various entry points to suit different needs and capabilities.

As Ethereum continues to develop and improve, staking will remain a fundamental component of its ecosystem, offering both opportunities and challenges for participants. By understanding the basics outlined in this guide, you're well-equipped to explore this important aspect of the Ethereum ecosystem further.

Key Takeaways

- •Ethereum staking is the process of depositing ETH to become a validator and help secure the network

- •Multiple staking options exist, from solo staking with 32 ETH to pooled staking with any amount

- •Staking rewards currently range from 3-5% APR, depending on the method and total ETH staked

- •Understanding the risks and technical aspects can help you make informed decisions about staking

- •The future of Ethereum staking includes protocol upgrades and innovations that will enhance its capabilities

To learn more about specific aspects of Ethereum staking, explore our other articles or try our staking calculator to estimate your potential rewards.