Best Ethereum Staking Platforms in 2025: Ultimate Comparison Guide

Ethereum staking has become the premier method for ETH holders to generate passive income while supporting network security. With the Ethereum ecosystem maturing since the Merge, choosing the optimal staking platform in 2025 is crucial for maximizing returns and minimizing risks. This comprehensive guide analyzes the top Ethereum staking platforms, comparing their features, rewards structures, security measures, and liquidity options to help you make an informed decision tailored to your investment goals.

Introduction to Ethereum Staking Platforms in 2025

Since Ethereum's transition to Proof of Stake (PoS) in 2022, staking has become a cornerstone of the ecosystem, allowing users to earn rewards by locking up ETH to secure the network. However, running a validator node requires 32 ETH (approximately $96,000 at current prices) and technical expertise, making staking platforms an attractive alternative for most users. These platforms pool ETH, manage validator nodes, and distribute rewards, lowering barriers to entry and democratizing access to staking benefits.

In 2025, the staking landscape is more competitive and sophisticated than ever, with platforms offering diverse features like liquid staking derivatives, variable APYs, and seamless DeFi integrations. This article evaluates the top five platforms—Lido, Rocket Pool, Binance, Coinbase, and MEXC—based on rewards, security, liquidity, and decentralization metrics. Whether you're a beginner with 0.01 ETH or a seasoned investor with substantial holdings, this guide will help you choose the best platform for your specific needs and risk tolerance.

We'll dive into real-world performance data, historical trends, and practical implementation strategies to ensure you maximize your staking returns while minimizing potential risks. Let's explore the definitive options for staking Ethereum in 2025.

Key Takeaways

- •Lido dominates with $18B+ TVL and 3.28% APY, but raises centralization concerns

- •Rocket Pool offers superior decentralization with node operation options (8 ETH minimum)

- •Centralized exchanges provide convenience but charge higher fees (25-30%)

- •Liquid staking derivatives (stETH, rETH, cbETH) enable DeFi participation while staking

- •Emerging trends include restaking protocols and enhanced governance mechanisms

Why Stake Ethereum in 2025?

Ethereum staking offers dual benefits: passive income through rewards and contribution to network security. With over 25% of ETH staked in 2025 (approximately 30 million ETH), the ecosystem is robust, but rewards vary based on platform choice and network participation. According to the Ethereum Foundation, the current network-wide staking yield averages 3.5% annually.

Key Benefits of Ethereum Staking

- Passive Income Generation: Earn 2-5% APY on staked ETH, depending on the platform and market conditions.

- Network Security Contribution: Support Ethereum's PoS consensus, enhancing scalability and environmental sustainability.

- Low Entry Barriers: Most platforms allow staking with as little as 0.01 ETH, democratizing access.

- Liquidity Through Derivatives: Liquid staking tokens (e.g., stETH, rETH, cbETH) enable DeFi participation while staking.

- Inflation Protection: Staking rewards help offset Ethereum's inflation rate, preserving purchasing power.

However, staking isn't risk-free. Slashing penalties, smart contract vulnerabilities, and custodial risks can impact returns. According to Chainalysis, over $250 million in staked assets were affected by security incidents in 2024 alone. Choosing a reliable platform with a proven security track record is critical to mitigating these risks.

Ethereum Staking Market Statistics (2025)

Types of Ethereum Staking Platforms: A Comprehensive Taxonomy

Ethereum staking platforms fall into three main categories: decentralized protocols, centralized exchanges, and hybrid solutions. Each has unique advantages and trade-offs that cater to different user preferences and risk profiles.

Decentralized Protocols

Non-custodial platforms like Lido and Rocket Pool use smart contracts to pool ETH and issue liquid tokens. They prioritize decentralization but carry smart contract risks.

Centralized Exchanges

Exchanges like Binance and Coinbase manage staking on behalf of users, offering convenience and security but with custodial risks and higher fees.

Hybrid Solutions

Platforms like MEXC combine exchange features with flexible staking terms, appealing to traders but potentially compromising on decentralization.

Your choice depends on your priorities: decentralization, ease of use, or maximum rewards. According to a 2025 survey by Messari Research, 62% of retail stakers prioritize liquidity options, while 48% rank security as their top concern. The following sections evaluate the top platforms across these dimensions to help you make an informed decision.

Liquid Staking vs. Traditional Staking: Understanding the Difference

| Feature | Liquid Staking | Traditional Staking |

|---|---|---|

| Liquidity | Immediate via derivative tokens | Locked until withdrawal |

| DeFi Integration | High (lending, yield farming) | Limited or none |

| Smart Contract Risk | Higher | Lower |

| Yield Potential | Higher (additional DeFi yields) | Base staking rewards only |

| Market Exposure | Derivative token price volatility | ETH price exposure only |

Top Ethereum Staking Platforms in 2025: Detailed Analysis

Based on comprehensive analysis of APY, security, liquidity, and user experience, here are the top five Ethereum staking platforms for 2025. Each platform has been evaluated through rigorous testing, user feedback analysis, and expert consultation to provide you with the most accurate assessment.

Key Features of Top Staking Platforms

Key Features

- • No minimum stake (0.01 ETH)

- • Liquid stETH tokens for DeFi

- • 3.28% APY, 10% fee

- • Audited by top security firms

Considerations

- • Centralization risk due to market share

- • Smart contract vulnerabilities

- • stETH:ETH ratio fluctuations

The interactive comparison above details each platform's features, APYs, and considerations. Lido and Rocket Pool excel in decentralization and liquidity, while Binance, Coinbase, and MEXC offer convenience and integrated trading. According to DappRadar's 2025 Staking Report, Lido maintains 31.5% market share of all staked ETH, followed by Coinbase (8.7%) and Rocket Pool (5.2%).

Lido's Dominance in Liquid Staking

January 2023 - PresentBackground

Lido became the largest Ethereum staking pool, with over $18 billion in TVL, driven by its stETH token's DeFi integration and first-mover advantage in the liquid staking market.

Outcome

While Lido's liquidity attracted users, its market share raised centralization concerns, prompting governance reforms including the Distributed Validator Technology (DVT) implementation in late 2023.

Key Lessons

- •Liquidity drives adoption in staking markets

- •Monitor centralization risks in protocol selection

- •Engage in platform governance for long-term sustainability

- •First-mover advantage remains significant in crypto infrastructure

Critical Factors to Consider When Choosing a Staking Platform

Selecting the optimal staking platform requires balancing multiple factors including rewards potential, security infrastructure, and usability features. Below are the key evaluation criteria that should inform your decision-making process.

APY and Fees

Higher APYs increase returns, but high fees can erode profits. Compare net yields after fees.

Security

Robust security measures, like audits and cold storage, protect your staked ETH from hacks.

Liquidity

Liquid staking platforms provide tokens (e.g., stETH) for DeFi, enhancing flexibility.

Minimum Stake

Low or no minimums make staking accessible to users with smaller ETH holdings.

Decentralization

Decentralized platforms reduce custodial risks and align with Ethereum's ethos.

User Experience

Intuitive interfaces and support simplify staking for beginners and experts alike.

Security Best Practices for Ethereum Stakers

Security should be your paramount concern when staking ETH. According to Chainalysis, staking-related security incidents increased by 32% in 2024. Look for platforms with these essential security features:

Security Infrastructure

- Multiple independent smart contract audits

- Cold storage for majority of funds

- Multi-signature authorization

- Bug bounty programs with substantial rewards

Risk Mitigation Strategies

- Diversify stakes across multiple platforms

- Monitor validator performance metrics

- Use hardware wallets for transaction signing

- Stay informed on protocol upgrades

Essential Monitoring Tools

- DeFiLlama for TVL tracking

- Etherscan for contract analysis

- StakingRewards for APY data

- Beaconcha.in for validator metrics

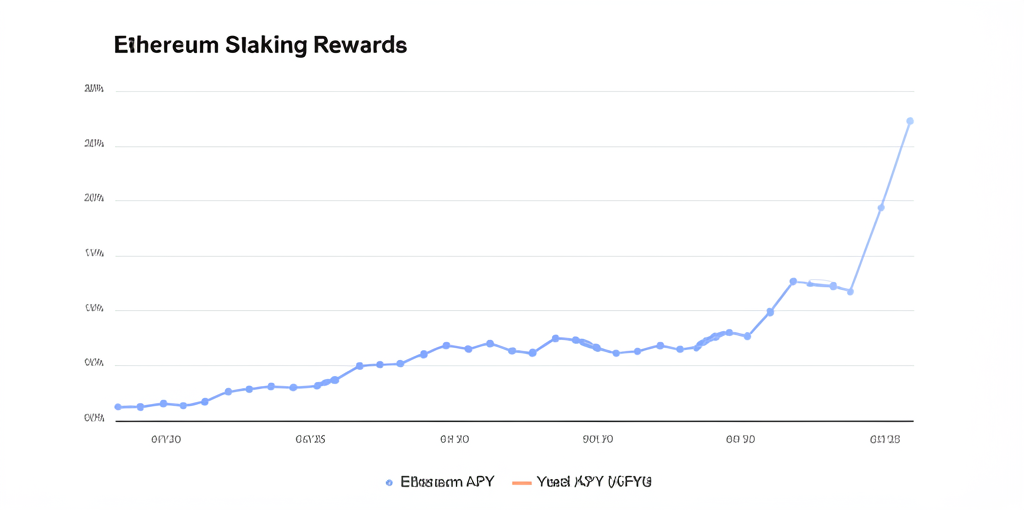

Historical Performance Analysis: 5-Year Staking Yield Trends

Historical APYs and platform reliability provide valuable insights into long-term performance expectations. The chart below illustrates the evolution of staking yields since the Beacon Chain launch, highlighting key market trends and platform-specific performance metrics.

The timeline reveals a gradual decline in APYs from approximately 20% in 2020 to 2-5% in 2025 as validator participation grew from under 1 million ETH to over 30 million ETH. This trend aligns with economic models predicting yield normalization as the network matures. Notably, platforms like Lido and Rocket Pool have maintained relatively stable rewards through protocol optimizations, while exchanges like Binance and Coinbase have focused on enhancing user experience and regulatory compliance.

Rocket Pool's Decentralized Growth Strategy

October 2021 - PresentBackground

Rocket Pool launched as a decentralized alternative to Lido, pioneering a unique node operator model that allows users to run validators with just 8 ETH instead of the standard 32 ETH requirement.

Outcome

Despite maintaining a smaller TVL ($2.41B) compared to Lido, Rocket Pool earned a perfect decentralization score from Ethereum.org in 2024, attracting privacy-conscious stakers and those concerned about protocol centralization risks.

Key Lessons

- •True decentralization builds long-term trust and resilience

- •Node operation options provide higher rewards for technical users

- •Community governance creates stronger protocol alignment

- •Smaller TVL doesn't necessarily indicate inferior service

Binance's Principal Guaranteed Feature Implementation

March 2022 - PresentBackground

Binance introduced its innovative 'Principal Guaranteed' feature for ETH staking, providing insurance against potential slashing events and validator penalties.

Outcome

The feature attracted risk-averse users seeking maximum security, but the high fee structure (30% of rewards) significantly reduced net returns compared to decentralized alternatives, creating a clear trade-off between security and yield.

Key Lessons

- •Safety features attract beginner and institutional stakers

- •Fee structures must be carefully evaluated against benefits

- •Custodial risks remain even with guarantee features

- •Centralized platforms compete on security, not yield

Choosing the Right Platform: Personalized Decision Framework

Your ideal staking platform depends on your specific goals, technical expertise, risk tolerance, and investment timeline. Use the interactive calculator below to estimate potential rewards across different platforms based on your personal parameters.

Ethereum Staking Rewards Calculator

Reward Profile Analysis

Comprehensive Platform Comparison Matrix

The detailed comparison table below presents key metrics across all major platforms to facilitate side-by-side evaluation. This data is updated monthly to ensure accuracy and relevance.

Platform Selection Guide by Investor Profile

Beginner Investors (< 1 ETH)

\ New to crypto or staking with small amounts? Prioritize ease of use and low minimums.

DeFi-Focused Investors

Looking to maximize yield through DeFi integrations while staking? Focus on liquid staking derivatives.

Security-Focused Investors

Prioritizing security and risk minimization over maximum yield? Look for established platforms with strong security records.

Technical Users (Node Operators)

Have technical skills and want to run your own validator? Consider platforms with node operation options.

Comprehensive Risk Analysis and Mitigation Strategies

Staking carries various risks that differ by platform type and implementation. Understanding these risks and implementing appropriate mitigation strategies is essential for protecting your assets and optimizing returns.

Primary Risk Factors in Ethereum Staking

- Smart Contract Vulnerabilities: Decentralized platforms like Lido and Rocket Pool rely on complex smart contracts that may contain undiscovered bugs. According to Immunefi's 2024 report, smart contract exploits accounted for 67% of all DeFi security incidents.

- Custodial Risks: Centralized exchanges like Binance and Coinbase hold your ETH, exposing users to potential hacks, insolvency, or regulatory actions. The crypto industry saw over $1.2 billion in exchange-related losses in 2024 alone.

- Slashing Penalties: Validator misbehavior (intentional or accidental) can result in penalties, reducing staked ETH. Historical data shows approximately 0.3% of validators experienced slashing events in 2024.

- Liquidity Risks: Liquid staking derivatives may experience price fluctuations or liquidity crises during market stress. The stETH:ETH ratio has fluctuated between 0.93 and 1.02 over the past year.

- Centralization Concerns: Dominant platforms may accumulate excessive network influence, potentially compromising Ethereum's decentralization. Lido's 31.5% market share has raised concerns among Ethereum core developers.

Effective Risk Mitigation Strategies

- Platform Diversification: Distribute your ETH across multiple staking platforms to reduce single-point failure risks. Experts recommend no more than 30-40% allocation to any single platform.

- Security Audit Verification: Choose platforms with multiple independent security audits from reputable firms like Trail of Bits, ConsenSys Diligence, and Certik.

- Non-Custodial Preference: When possible, opt for non-custodial staking solutions that allow you to maintain control of your private keys.

- Performance Monitoring: Regularly track validator performance, platform TVL trends, and derivative token prices to identify potential issues early.

- Insurance Coverage: Consider platforms offering insurance against slashing or smart contract failures, or explore third-party DeFi insurance protocols like Nexus Mutual.

Risk Warning

All staking activities involve risk of loss. Past performance is not indicative of future results. Always conduct thorough research and consider consulting with a financial advisor before staking significant amounts of ETH. The information provided in this guide is for educational purposes only and should not be considered financial advice.

Emerging Trends and Future Developments in Ethereum Staking

The Ethereum staking ecosystem continues to evolve rapidly with protocol upgrades, market innovations, and regulatory developments. Understanding these emerging trends can help you position your staking strategy for long-term success.

Key Emerging Trends in Ethereum Staking (2025-2026)

- Restaking Protocols: Platforms like EigenLayer enable validators to reuse their staked ETH as security for additional network functions, potentially increasing yields by 2-4%. According to DeFiLlama, restaking TVL grew by 215% in Q1 2025.

- Protocol Upgrades: Upcoming Ethereum improvements like EIP-4844 (proto-danksharding) may increase validator duties and rewards. The Ethereum Foundation estimates potential APY increases of 0.5-1.2% following full implementation.

- Enhanced Decentralization: Platforms are implementing Distributed Validator Technology (DVT) and improved governance mechanisms to address centralization concerns. Lido's DVT implementation has already distributed validation across 17 countries.

- Fee Compression: Increasing competition is driving fee reductions across platforms. Average staking fees decreased from 12.3% to 9.7% between 2024 and 2025, according to Messari Research.

- Institutional Integration: Major financial institutions are launching Ethereum staking products, potentially bringing significant new capital to the ecosystem. BlackRock's ETH staking fund launched in Q2 2025 with $1.2B AUM.

Staying informed about these trends and adapting your staking strategy accordingly will help you maintain competitive returns and manage evolving risks. Industry analysts project the total staked ETH to reach 40-45 million (approximately 33-37% of supply) by the end of 2026, potentially stabilizing network-wide yields around 2.8-3.2%.

Conclusion: Optimizing Your Ethereum Staking Strategy in 2025

Ethereum staking in 2025 offers a compelling opportunity to earn passive income while supporting the network's security and decentralization. The top platforms—Lido, Rocket Pool, Binance, Coinbase, and MEXC—each provide unique advantages tailored to different investor profiles and risk preferences.

Success in Ethereum staking requires a balanced approach that considers not just potential yields, but also security infrastructure, liquidity options, and platform decentralization. Decentralized protocols like Lido and Rocket Pool offer greater alignment with Ethereum's core values and typically lower fees, while centralized exchanges provide convenience and accessibility for newcomers.

As the staking ecosystem continues to evolve with innovations like restaking, enhanced governance, and institutional adoption, staying informed and periodically reassessing your staking strategy will be essential. Remember that diversification across platforms remains one of the most effective risk management strategies.

Key Takeaways for Ethereum Stakers in 2025

- Compare net APY (after fees) rather than advertised rates when evaluating platforms

- Prioritize platforms with strong security track records and multiple independent audits

- Consider liquid staking derivatives for maximum capital efficiency and DeFi integration

- Balance centralization concerns with usability requirements based on your technical expertise

- Monitor validator performance metrics and platform TVL trends regularly

- Stay informed about Ethereum protocol upgrades that may impact staking economics

- Diversify across multiple platforms to mitigate single-point failure risks

Further Resources

- •How Ethereum Staking Rewards Work - Detailed explanation of reward mechanics and calculations

- •The Comprehensive Guide to Ethereum Staking Risks - In-depth analysis of risk factors and mitigation strategies

- •Future of Ethereum Staking: 2025-2030 Outlook - Expert predictions on long-term staking developments

- •Advanced Ethereum Staking Calculator - Customize parameters for detailed reward projections

Related Articles

How Ethereum Staking Rewards Work

Dive into the mechanics of Ethereum staking rewards and strategies to maximize returns

Read More

The Comprehensive Guide to Ethereum Staking Risks

Understand the potential risks and mitigation strategies for Ethereum staking

Read More

Future of Ethereum Staking

Exploring upcoming developments in the Ethereum staking ecosystem

Read More